Even so, Avant has a high 4.7 star rating on Trustpilot.Įligibility: Avant aims to provide credit services to a range of customers, including those with fair credit. We reached out to Avant to find out what they’ve done to adjust practices since the settlement but did not receive a response. According to FTC documents, the lawsuit was filed in response to allegations that, among other things, Avant charged consumers late fees and interest they didn’t owe and collected payments from customers without permission or in amounts larger than authorized. It’s also worth noting that Avant agreed to a $3.85 million settlement with the Federal Trade Commission (FTC) in April 2019. Still, the platform earns top marks for borrowers with less than stellar credit who need quick access to funds. In addition to charging an administrative fee of up to 4.75% of the loan amount, Avant’s APR range (9.95% to 35.99%) is on the high end for applicants with a good to excellent credit score-and there is no autopay discount. However, as with many loans for subprime borrowers, Avant personal loans come with a price. Maximum loan amounts are low compared to other lenders, but the low minimum amount and flexible repayment terms (two to five years) make it an accessible option for borrowers. The platform specializes in middle-income borrowers with fair to good credit and only requires a minimum score of 580 to qualify. and every state but Hawaii, Iowa, New York, Vermont, West Virginia and Maine. Unsecured loans are available in Washington, D.C. Its loans come with flexible repayment terms of two to five years.įounded in 2012 and based in Chicago, Avant is a consumer lending platform that offers secured and unsecured personal loans through a third-party bank (WebBank). Best for a Range of Repayment OptionsĪvant specializes in lending to middle-income borrowers and offers both secured and unsecured loans.

CREDIT SCORE RANGES 658 UPGRADE

However, if Upgrade is directly paying off a borrower’s loans to a third-party lender, it can take up to two weeks for the funds to clear. Turnaround time: Once an Upgrade loan is approved, it generally takes up to four business days for a borrower to receive the funds.

There are no specific prohibitions on the use of Upgrade loans other than those already imposed by law. What’s more, Upgrade will directly pay off third-party lenders, making debt consolidation more convenient than with some competing lenders. However, Upgrade stands out from some lenders by allowing borrowers to use personal loan funds to cover business expenses. Loan uses: As with most other personal loans, loans from Upgrade must be used to pay off credit cards, consolidate other debt, make home improvements or pay for other large purchases. Upgrade increases loan accessibility by also allowing co-applicants. Ideally, applicants should have a minimum monthly cash flow of $800.

CREDIT SCORE RANGES 658 FREE

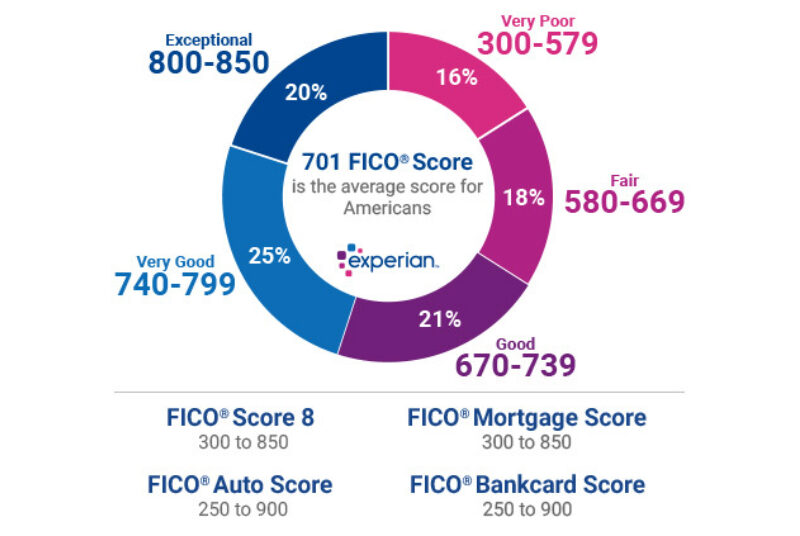

The lender also considers each applicant’s free cash flow, which demonstrates their likely ability to make consistent on-time loan payments. Applicants should have a maximum pre-loan debt-to-income ratio of 45%, excluding their mortgage. Furthermore, the lender does not require applicants to meet a minimum income requirement, although borrowers make $95,000 per year on average. Upgrade’s Credit Heath tool also makes it easy to track your credit score over the life of your loan.Įligibility: Prospective borrowers should have a minimum score of 580 to qualify for an Upgrade personal loan (the average borrower score is 697), making it an accessible option for those with fair credit.

CREDIT SCORE RANGES 658 UPDATE

That said, Upgrade borrowers are not subject to a prepayment penalty, so you can reduce the overall cost of the loan if you’re able to pay it off early.īeyond offering accessible personal loans, Upgrade streamlines the lending process with a mobile app that lets borrowers view their balance, make payments and update personal information. Upgrade charges an origination fee between 1.85% and 9.99% of the loan, and borrowers will encounter a $10 fee if their payment is more than 15 days late or if the payment does not go through there are no discounts for autopay. Upgrade has two- to seven-year terms available. Loans amounts, which range from $1,000 to $50,000. Although maximum APRs are on the high end compared to other online lenders, Upgrade makes loans available to those with poor credit history. Since that time, the platform has made more than $3 billion in credit available to over 10 million applicants and continues to expand its online and mobile services. Upgrade was launched in 2017 and provides accessible online and mobile credit and banking services.

0 kommentar(er)

0 kommentar(er)